Fashmates: A Social Networking Platform for Fashion Enthusiasts

September 8, 2020

LIXR: India’s First Digital Party Assistant

August 2, 2024

The Veritas Unified App exemplifies a commitment to excellence in mobile app development, showcasing how targeted technology can drive substantial improvements in customer experience and operational efficiency.

Client Overview

Veritas Finance Private Limited is a prominent Non-Banking Finance Company (NBFC) registered with the Reserve Bank of India. Focused on serving the financial needs of micro, small, and medium enterprises (MSMEs) in India, Veritas has a substantial loan book of Rs. 5,724 crores, supported by a network of 382 branches and over 176,000 customers. The company is dedicated to making credit accessible and fostering positive economic impact.

Project Vision

Veritas Finance sought to develop a mobile application to simplify financial management for MSMEs, with objectives including:

- Enhancing transparency in financial transactions.

- Providing easy access to loan information and documents.

- Enabling secure and convenient online payments.

- Improving overall customer experience and engagement.

The Creative Journey

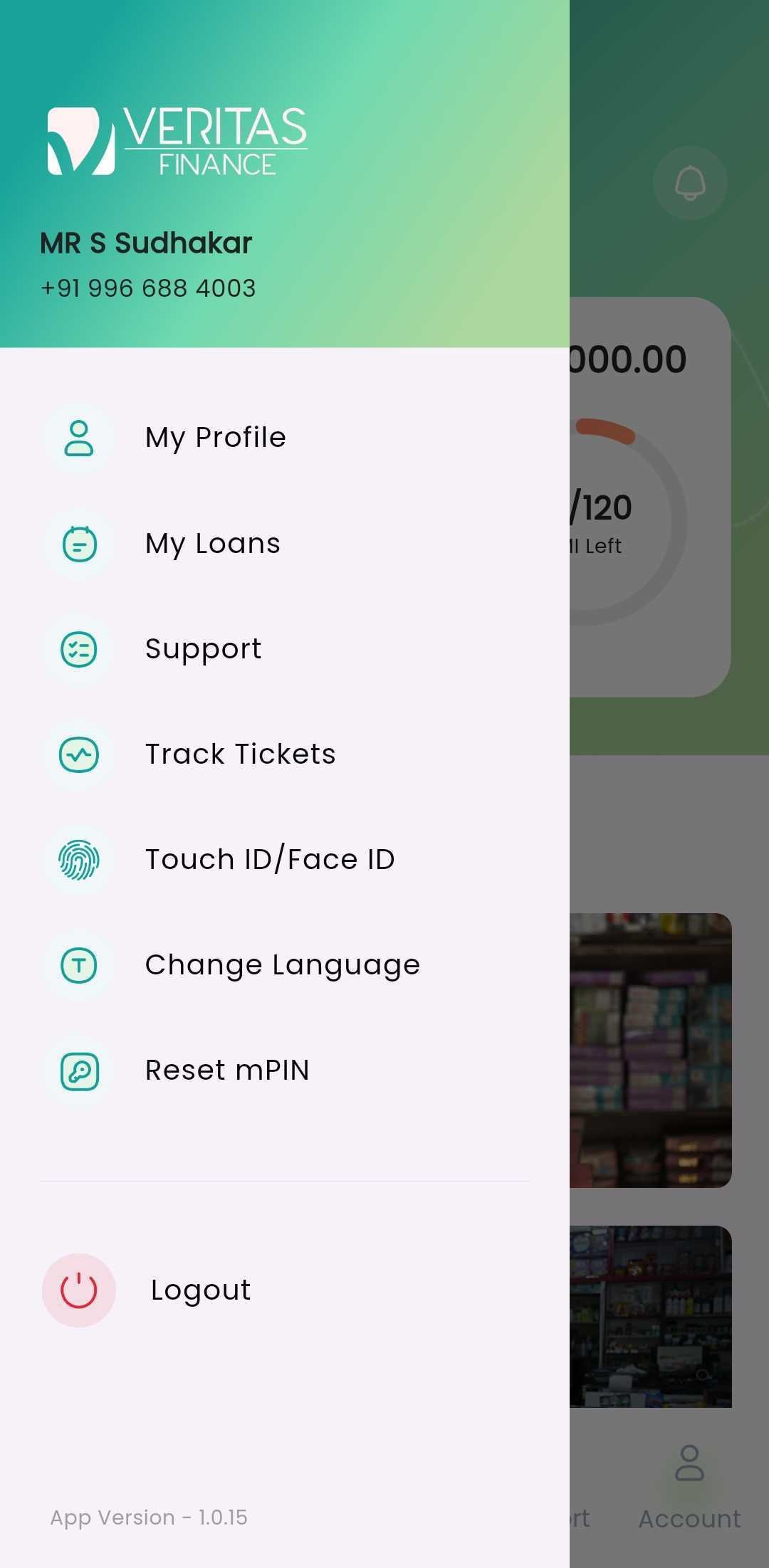

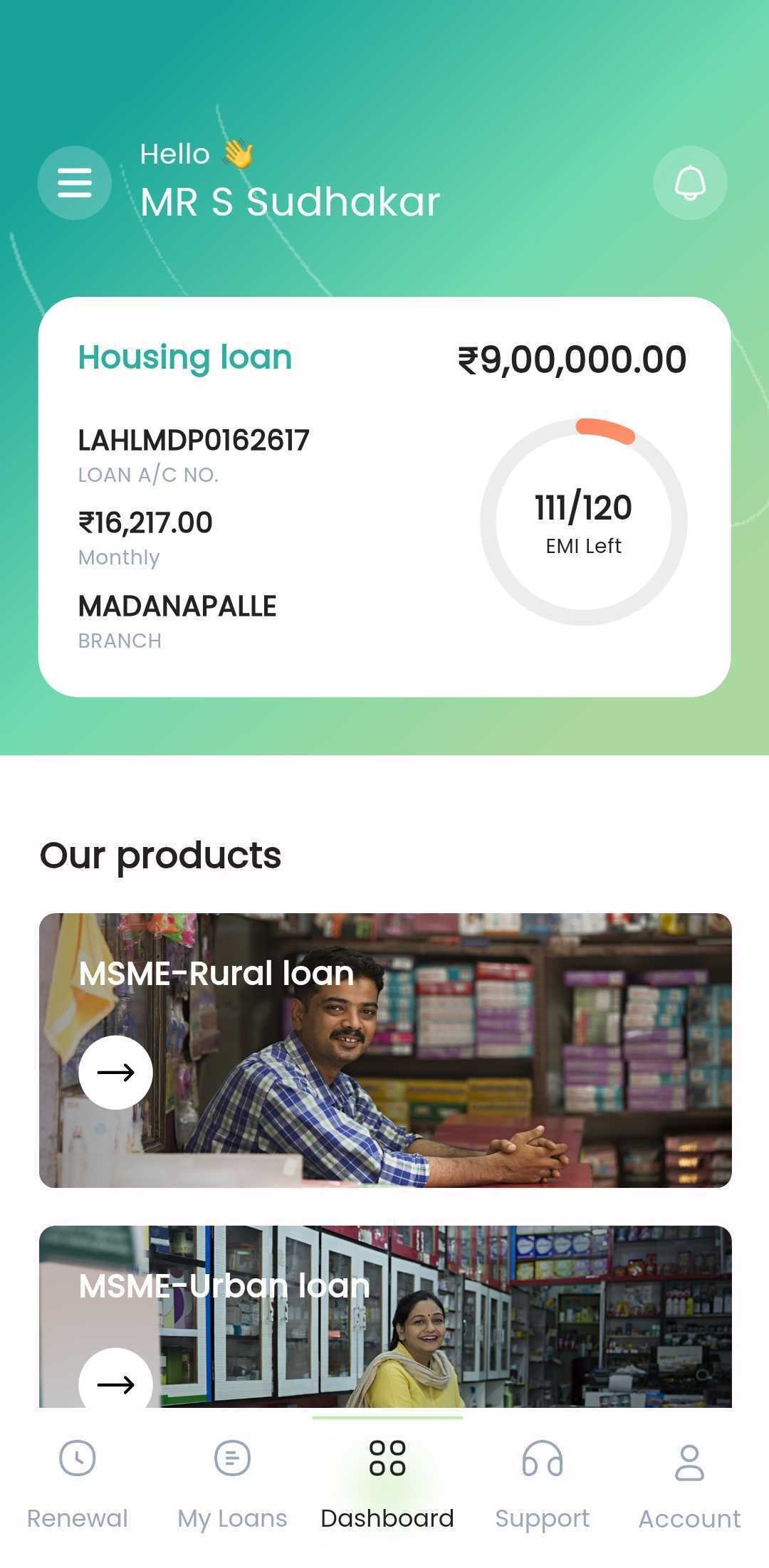

The development of the Veritas Unified App focused on delivering a seamless and powerful financial management tool. The app’s features include:

- View Passbook: Real-time access to account activity, balances, transactions, and financial history.

- Loan Tracking: An intuitive interface for monitoring loan status and managing repayments.

- Online Payment: Secure online payments for smooth financial transactions.

- Loan Documents: Easy access to essential loan documents, ensuring users are always prepared.

Transformative Impact

The Veritas Unified App has significantly enhanced financial management for Veritas Finance’s MSME clients. Key outcomes include:

- Improved User Experience: The app’s intuitive design and real-time features have boosted user engagement and satisfaction.

- Operational Efficiency: Streamlined processes have reduced the time and effort required for financial management tasks.

- Empowered Decision-Making: Enhanced access to financial information has enabled MSME owners to make more informed decisions.